Pre-IPO Company Guide For Job Seekers

Candidates are swarming to private tech companies, but how do they pick one and value their equity?

Table of Contents

Introduction: The High-Stakes World of Pre-IPO Companies

The Pre-IPO Landscape: Understanding the Playing Field

Current Market Dynamics: A Tale of Two Trends

The ZIRP Era Hangover: How Past Policies Shape Today's Opportunities

Sector-Specific Trends: Not All Tech is Created Equal

Top Pre-IPO Companies Analysis

Full List of Pre-IPO Companies

Company Profiles

Key Metrics to Watch

Industry Comparisons

Equity Compensation

Types of Equity: Options, RSUs, and More

Understanding Your Offer

Valuation and Dilution

Risk Management

Diversification Strategies

Dollar-Cost Averaging

Tax Planning

Long-Term Holding

Employee Stock Purchase Plans (ESPPs)

Post-IPO Participation

Benefits and Risks

Navigating Company Culture and Employee Treatment

Analyzing Culture Beyond Perks

Case Studies of Controversial Practices

Effective Research and Backchannel Strategies

Reverse Interviewing

Legal and Financial Considerations

Key Clauses in Equity Agreements

Tax Implications of Different Equity Structures

When to Seek Professional Advice

Future Outlook

Potential Regulatory Changes

Emerging Trends in Company Formation and Funding

Strategies for Long-Term Career Resilience

Conclusion

Making Informed Decisions in the Pre-IPO World

Key Takeaways

Balancing Opportunities and Risks

Final Thoughts on Navigating Your Tech Career

1. Introduction: The High-Stakes World of Pre-IPO Companies

With fewer public company roles and layoffs continuing, as a tech professional in 2024, you’re probably considering joining pre-IPO companies. They promise innovation, wealth, and career advancement. These companies, often unicorns (>$1 billion valuation) or decacorns (>$10 billion), can seem like golden tickets. But, as you know, the reality is far more complex and risky.

Consider this: In 2023, the tech industry saw over 260,000 layoffs (layoffs.fyi), while only 142 companies went public, down from 980 in 2021 (NYSE data). This stark contrast highlights the volatility and uncertainty in the pre-IPO landscape.

Even the most sure-fire rocketships can change trajectory.

I personally have worked at several pre-IPO unicorns, all of which are still private. One of them, Noom, like many other of the high growth B2C companies at the time, was reportedly planning a 2022 IPO at a $10 billion valuation after raising funds from Silver Lake. That window quickly shut as public market demand turned off after market shifts heading into 2022.

The major catalyst was the end of zero-interest rate policies (ZIRP) as interest rates were hiked starting in March 2022 to combat inflation. This led valuation-to-sales multiples to decline and a ripple effect of high-cost capital causing funding to dry up. Consumer and enterprise demand trends, acquisition cost changes, and competitive dynamics post-pandemic all contributed to the number of private companies with declining valuations, declining business growth, and no clear exit paths in sight.

In this guide, we’ll:

Dive deep into the current pre-IPO market

Analyze top companies

Decode equity compensation & ways to cash out

Explore strategies for evaluating high-risk, high-reward opportunities

Help you make informed decisions tied to personal and professional goals

Let's begin our trek through the pre-IPO jungle.

The Growing Trend: Three Archetypes of Pre-IPO Joiners

In this changing landscape, more professionals are considering pre-IPO opportunities. They generally fall into three categories:

"Have to": Entering the pre-IPO world out of necessity due to layoffs, hiring freezes, or lack of interview ability.

"Want to": Risk-takers who prefer fast-moving private companies to the more established public giants.

"Convinced to": Initially hesitant but persuaded by senior titles, more scope and impact, or a compelling vision. AI startup proliferation is adding even more fuel to this group.

This trend is driven by recent big tech layoffs, creating a pool of talented professionals looking for new opportunities. As established companies become leaner, pre-IPO companies become a compelling alternative.

Why does this matter to you? Joining a pre-IPO company is a high-stakes decision that can significantly impact your financial future and career path. Whether you identify with one of these types or are curious about pre-IPO opportunities, this guide aims to equip you with the knowledge and tools to navigate this complex landscape.

2. The Pre-IPO Landscape: Understanding the Playing Field

The tech industry in 2024 presents a paradox that directly affects your career options. There was an explosion to over 1,200 unicorns worldwide as of 2023. But, there are way fewer tech companies going public. This presents both challenges and opportunities for tech workers like you.

Current Market Dynamics: A Tale of Two Trends

Unicorn & Decacorn Proliferation: The abundance of highly valued private companies might suggest a landscape rich with opportunities. However, it's important to look beyond the surface. Many of these unicorns are facing challenges in living up to their lofty valuations, leading to a phenomenon known as "paper unicorns" – companies valued at over $1 billion on paper but struggling to justify that valuation in real terms.

And we are seeing a very similar trend for decacorns (>$10 billion valuation).

Aside: I recommend and ’s article on unicorns as well as this one by Aileen Lee, who coined the phrase “unicorn”.

IPO Drought: Despite the plethora of unicorns and decacorns, few are making the leap to public markets. In 2023, only 142 companies went public globally, a stark contrast to the 980 IPOs in 2021. This trend has significant implications for your potential equity value and liquidity timeline.

What does this mean for you? This means there's a higher risk that the company will stay private longer than expected, delaying your chance to cash in on your equity. When evaluating opportunities, consider both the current valuation and the company's realistic path to an exit event.

The ZIRP Era Hangover: How Past Policies Shape Today's Opportunities

The Zero Interest Rate Policy (ZIRP) era, which lasted from 2008 to 2022, has left a lasting mark on the tech industry. Its effects continue to shape the companies you might be considering joining:

Inflated Valuations: Easy access to capital led to skyrocketing valuations, often disconnected from fundamentals. Many companies raised funds at valuations that now seem overly optimistic in the current market climate.

Example: Stripe's valuation soared to $95 billion in 2021 but dropped to $50 billion by 2023 as market conditions changed. This dramatic shift illustrates the potential volatility of your equity value.Growth at All Costs Mentality: Many companies prioritized rapid expansion over profitability. This approach worked well in an environment of cheap money but has become problematic as investors increasingly focus on sustainable business models.

Case Study: Klarna's valuation dropped from $45.6 billion to $6.7 billion in 2022. And although they target a Q3 2024 IPO at $20 billion, employees who received stock before saw their value drop by half or more. This dramatic decrease highlights the potential risks in the fintech sector, especially for companies with business models heavily reliant on consumer spending and lending.Extended Private Periods: Abundant private capital allowed companies to delay going public. This trend has extended the timeline for potential liquidity events, affecting your ability to realize gains from equity compensation.

Statistic: The median age of tech companies at IPO increased from 7.9 years in 2018 to 12.3 years in 2022 (PitchBook data). This trend directly impacts your liquidity timeline and should factor into your decision-making process.

Why This Matters to You:

These trends have created a landscape where the promise of pre-IPO equity comes with increased uncertainty. As you evaluate opportunities, consider how these factors might affect your long-term financial and career goals. The companies you're considering may be grappling with the consequences of ZIRP-era decisions, which could impact their stability and growth prospects.

Private Companies Are Not Worth What You Think

Valuations for late stage private companies were all down significantly in Q1 2024. “23% of all new rounds in Q1 were down rounds, the highest rate in more than five years.” (Carta)

On secondary private share marketplace Forge, where employees and investors sell their shares in private companies to other investors, the valuation discounts are down, but actually bouncing back.

For the month, private companies on Forge Markets traded at a median discount of -31%, which represents the smallest discount in two years. The top 10% of companies traded at a 47% premium and the top 25% of companies traded flat to their primary valuations.

But maybe Public markets will treat them differently than Secondary markets?

You can see that the private markets haven’t performed as well as public markets. There have been record startup shut downs and deflated valuations (as determined by how much people are willing to pay on secondary markets or investors in down rounds).

Public companies have been saved by having some liquidity on the public markets. Startups were overvalued, had high burn rates, and ran out of investors willing to inject capital after funds got burned since 2022.

Not all IPOs thrived, with 23andme taking in valuation. At least there was a liquidity event for earlier employees.

Sector-Specific Trends: Not All Tech is Created Equal

The tech industry is not monolithic, and your experience and potential returns can vary dramatically depending on the sector. Let's explore how different sectors are faring in the current environment:

1. AI (Artificial Intelligence):

This sector continues to see strong interest and valuations, driven by breakthroughs in areas like large language models and generative AI. Companies in this space are attracting significant investment and talent.

Example: Anthropic raised $450 million in 2023 at a valuation over $4 billion. This level of funding in a challenging market underscores the sector's perceived potential.

Career Implication: There's high demand for AI talent, potentially leading to generous compensation packages. However, the rapid pace of innovation means you'll need to stay at the cutting edge to remain competitive. Even if the company fails, you still get exposure to the space for your next role.

Watch out: Even the successful AI businesses might not be able to grow into their valuations even at reasonably high growth rates when valuation multiples come back down to earth.

Just be wary of the high valuations. Even if AI will produce great companies, every wave leaves >99% of the early companies in the graveyard or in small acquisitions.

2. Fintech:

The fintech sector has seen more volatility, with some high-profile companies experiencing significant valuation fluctuations. This volatility reflects both the sector's potential for disruption and its sensitivity to economic conditions. Just look at Robinhood or Coinbase stock fluctuations post-IPO.

Career Implication: Fintech offers the potential for high rewards but comes with increased risk. When considering a fintech opportunity, pay close attention to the company's path to profitability and its resilience to economic downturns.

3. Enterprise SaaS:

This sector has shown relative resilience, particularly in areas like cybersecurity and data analytics. The ongoing digital transformation across industries continues to drive demand for enterprise software solutions.

Example: Databricks has maintained its high valuation ($43 billion as of 2023), reflecting continued investor confidence in its data and AI platform.

Career Implication: Enterprise SaaS might offer more stability and steady growth compared to consumer-focused tech. However, it might lack the explosive upside potential seen in emerging tech sectors. Professionals specialized in this field weren’t immune to the downturn , but had an easier time finding roles than Consumer sector tech workers.

4. Consumer Tech:

The consumer tech sector has generally faced more challenges, with some notable exceptions. Many consumer-focused startups have struggled with user acquisition costs, changing privacy regulations, and shifting consumer behaviors.

Avoid Consumer?

Of course, Consumer startups are getting the biggest discounts to their valuations. We have Series B data here, but it applies to late stage pre-IPO companies:

Example: Instacart's IPO in 2023 at a $9.9 billion valuation, down from a peak private valuation of $39 billion, illustrates the challenges in this sector. And that is a company with some network effects. Many of the D2C consumer companies had few moats and only grew on inexpensive-yet-volatile paid advertising arbitrage.

Career Implication: Be cautious when considering consumer tech opportunities. Look for companies with strong unit economics, strong retention, network effect or brand moats, a large serviceable market, and a clear path to profitability, not just user growth and acquisition cost efficiency.

As you navigate the pre-IPO landscape, understanding these sector-specific trends can help you align your career choices with sectors that match your risk tolerance and growth expectations.

3. Top Pre-IPO Companies Analysis: A Deep Dive

Understanding the landscape of top pre-IPO companies provides crucial context for any opportunity you're considering. Let's examine some of the most noteworthy pre-IPO companies as of 2024, and then dive into specific cases that illustrate key lessons for tech professionals.

This map gives a sense of the full list of unicorns who are potential IPO candidates, but we know first hand that many of these are NOT going to IPO in the next couple of years, if ever.

Here is the full 250+ unicorn list in a sheet.

Now, let's explore some of these companies in detail to understand what they can teach us about the pre-IPO landscape:

Stripe: The Valuation Rollercoaster

Stripe's journey exemplifies both the potential and pitfalls of the pre-IPO world. Its valuation soared to a peak of $95 billion in 2021, making it one of the most valuable private companies globally. However, by 2023, this valuation had dropped to $50 billion, a stark reminder of the volatility in private market valuations.

What This Means for Employees:

Equity Grant Timing is Crucial: The timing of your equity grant can significantly impact its potential value. An employee granted options at the $95 billion valuation might now have underwater options, meaning the current stock price is below the grant price.

Example: If you were granted 10,000 options with a strike price based on the $95B valuation, they might be worth significantly less now. This scenario underscores the importance of understanding the long-term value potential of your equity, not just its value at grant.

Layoff Risk in Highly Valued Companies: Despite its high valuation, Stripe laid off 14% of its workforce in 2022. This move highlights that even highly valued companies are not immune to market pressures and the need for cost-cutting measures.

Lesson: High valuations don't guarantee job security. When evaluating a pre-IPO opportunity, look beyond the valuation to understand the company's financial health and market position.

Resilience Matters: Despite the down round, Stripe remains a leader in its space with strong fundamentals. This resilience demonstrates the importance of assessing a company's core business strength, not just its current valuation.

Career Implication: When considering a pre-IPO company, evaluate its ability to weather market downturns and maintain its competitive position.

Databricks: Riding the AI Wave

Databricks presents a different narrative in the pre-IPO world. The company has maintained a strong position even in a challenging market, with its valuation holding steady at $43 billion in 2023. Its focus on data and AI has positioned it well in a high-growth sector.

What This Means for Potential Employees:

Sector Matters: Databricks' success underscores the importance of sector positioning. Its focus on AI and data analytics places it in a high-growth area with strong market demand.

Career Implication: Developing skills in AI and data science could position you well for opportunities in companies like Databricks. Consider how your skillset aligns with high-growth sectors when evaluating pre-IPO opportunities.

Consistent Growth Can Lead to Steady Equity Appreciation: Databricks has seen consistent upward valuation trajectory, which can translate to significant equity value for employees.

Example: An early employee granted options at a $1 billion valuation could have seen a 43x increase in equity value. This scenario illustrates the potential upside of joining a company with strong growth prospects early in its journey.

High Valuations Set High Bars: At $43 billion, Databricks will need significant growth to provide further upside for new employees joining at this valuation.

Consideration: When joining a company at a high valuation, assess the realistic growth potential from that point. The most significant equity gains often come from earlier-stage investments.

Instacart: A Cautionary IPO Tale

Instacart's 2023 IPO serves as a wake-up call for pre-IPO equity valuation. The company went public at a valuation of $9.9 billion, a dramatic decrease from its peak private valuation of $39 billion in 2021. This stark difference highlights the potential gap between private and public market valuations.

Crucial Lessons for Tech Professionals:

Private Valuations Can Be Inflated: The public market often values companies differently than private investors. This disparity can lead to significant adjustments when a company goes public.

Calculation Example: An employee with options based on a $39B valuation might have seen their potential equity value drop by 75% at IPO. This dramatic decrease underscores the importance of tempering expectations and not relying too heavily on paper valuations.

The Importance of Vesting Schedules: Employees who joined Instacart at its peak valuation but hadn't fully vested might have seen much of their expected equity value evaporate. This scenario highlights the critical role of vesting schedules in realizing equity value.

Tip: Always consider the vesting schedule in relation to potential exit timelines. A longer vesting period might expose you to more valuation risk but could also allow for potential recovery or growth.

Market Conditions Impact IPO Success: Instacart's IPO came during a period of market skepticism towards high-growth, unprofitable tech companies. This timing likely contributed to its lower public valuation.

Implication: When evaluating a pre-IPO opportunity, consider not just the company's performance but also broader market conditions and sentiment towards similar companies.

Less Flashy but Notable Contenders

While the unicorns often grab headlines, it's worth paying attention to some less flashy but potentially promising pre-IPO companies:

StubHub and SeatGeek: Both ticketing platforms are eyeing 2024 IPOs. StubHub is aiming for a valuation of at least $16.5 billion, while SeatGeek's plans are less clear.

Lesson: The live events industry's recovery post-pandemic has boosted these companies' prospects. When evaluating pre-IPO opportunities, consider broader industry trends and post-pandemic recovery patterns.

Turo: The peer-to-peer car-sharing platform has been considering an IPO but faces challenges meeting the increasingly high bar for going public.

Implication: Companies now often need $1 billion in revenue and a $10 billion valuation to be considered IPO-ready. This raises the stakes for employees joining pre-IPO companies, as the path to liquidity may be longer and more uncertain.

OpenAI: While not traditionally structured as a for-profit company, OpenAI is reportedly considering restructuring to enable a potential IPO.

Takeaway: Even non-traditional company structures in hot sectors like AI are exploring paths to liquidity. This underscores the importance of understanding a company's structure and potential exit strategies when evaluating opportunities.

These case studies illustrate the complex and often unpredictable nature of pre-IPO valuations and exits. As you navigate your own career decisions, use these lessons to inform your due diligence process and set realistic expectations for potential equity value.

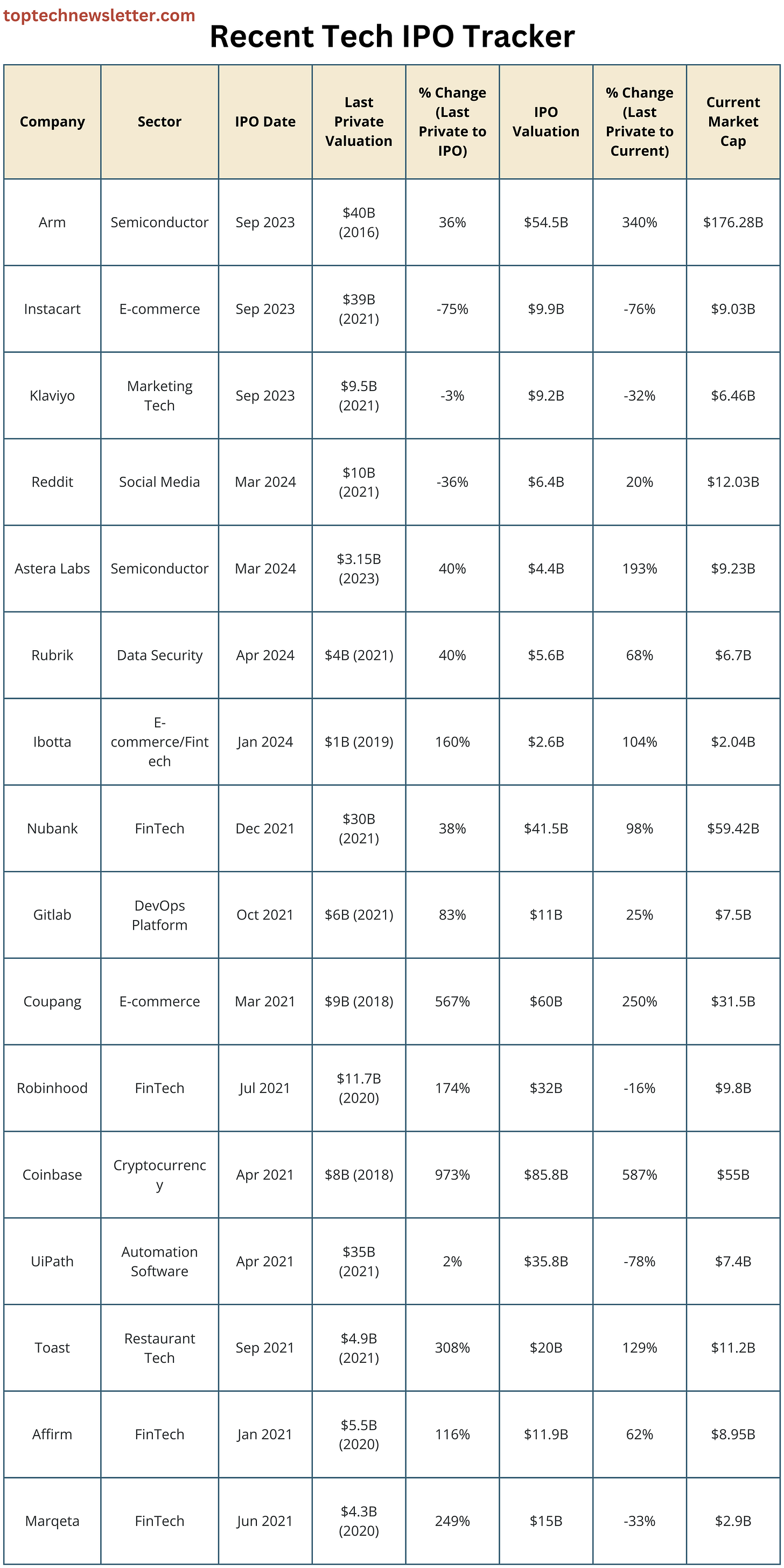

Recent IPOs

You can see that if you joined some recent tech IPOs before they went public, you could have a large outcome (Coupang +567% on IPO) or a big loss, maybe even below your strike price (Instacart -75%).

And this mixed bag is in a relatively healthy post-IPO market in comparison to the drops in IPO prices immediately following 2021 IPOs.

4. Evaluating Pre-IPO Opportunities: Your Due Diligence Toolkit

When considering a pre-IPO opportunity, thorough due diligence is crucial. Here's a comprehensive toolkit to help you evaluate these high-stakes opportunities:

Financial Health Assessment

1) Revenue Growth: Look for consistent year-over-year growth. For SaaS companies, focus on Annual Recurring Revenue (ARR) growth.

How to obtain this information:

Ask directly during interviews about revenue milestones and growth rates.

Research press releases or news articles mentioning revenue figures.

Check platforms like PitchBook or CB Insights for estimates.

Red Flag: Slowing or stagnant revenue growth could indicate market saturation or product issues.

2) Burn Rate and Runway: Understand how quickly the company is spending money and how long current funds will last.

Key questions to ask:

"What's the company's current runway?"

"When do you anticipate the next funding round?"

"How has the burn rate changed over the past year?"

Red Flag: A runway of less than 12 months without a clear path to additional funding or profitability is concerning.

3) Unit Economics: Assess the profitability of the core business model.

Key metrics to inquire about:

Customer Acquisition Cost (CAC)

Customer Lifetime Value (CLV aka LTV)

Gross Margin

Net Revenue Retention

Ideal Scenario: CLV should be at least 3x CAC for a healthy business model.

Flag: Even with healthy LTV/CAC, if the business is low retention or the CAC is volatile (e.g. paid ads), there is still significant risk. This is why so few consumer subscription businesses succeed - they have very high churn rates relative to business SaaS (exceptions: Netflix, Duolingo).

Market Position Analysis

1) Market Size and Growth: Evaluate the total addressable market (TAM) and its growth trajectory.

Strategy: Cross-reference the company's claims with industry reports from firms like Gartner or Forrester.

If you want to go deeper, investigate their Serviceable Addressable Market (SAM) as well, which can give you a better view. e.g. Health markets can be 100s of billions, but the serviceable market of that particular company may only be a small segment of that.

Also look out for trends in these markets. Are they growing or declining?

2) Competitive Landscape: Understand who the major players are and the company's unique value proposition.

Approach:

Use tools like G2 Crowd or Forrester Wave reports to see how the company stacks up against competitors.

Ask about the company's win rate in competitive deals and their key differentiators.

Red Flag: If the company can't clearly articulate its unique value proposition or how it differs from competitors, it may struggle to maintain market share.

3) Customer Traction: Look for evidence of strong customer adoption and retention.

Questions to ask:

"Who are some of your flagship customers?"

"What's your customer retention rate?"

"How has your customer base grown over the past year?"

Positive Sign: A diverse customer base with high retention rates and growing accounts indicates product-market fit.

4) Technological Moat: Assess the uniqueness and defensibility of the company's technology.

Strategies:

Research patent filings (accessible through Google Patents)

Ask about the company's R&D investments and innovation pipeline

Inquire about any proprietary technologies or algorithms

Example: Stripe's advanced fraud detection algorithms and extensive integrations create a significant barrier to entry for competitors.

5) Other Moats: In addition to traditional competitive advantages, consider other strategic "moats" that can protect the company's market position and drive long-term success.

Network Effects: Companies that benefit from network effects see their product or service become more valuable as more people use it. This creates a virtuous cycle of growth and user retention. For example, social media platforms like Facebook and LinkedIn become more indispensable as their user bases expand, making it difficult for new entrants to compete.

Brand Strength: A strong, trusted brand can be a significant moat, creating customer loyalty and allowing for premium pricing. For instance, Apple's brand strength not only drives consistent demand but also enables the company to command higher margins compared to competitors.

Proprietary Data: Companies with access to unique, high-quality data can leverage this asset for competitive advantage. For example, Google's vast amount of search data enables it to continuously improve its algorithms and offer more targeted advertising, creating a barrier to entry for other search engines.

Regulatory Advantages: Sometimes, regulatory environments can act as a moat. Companies that navigate complex regulations effectively or benefit from favorable regulatory conditions can deter new competitors. For example, financial institutions with robust compliance frameworks can better manage regulatory risks compared to newer fintech startups.

Customer Switching Costs: High switching costs can lock customers into a company's ecosystem. For example, enterprise software providers like Salesforce benefit from significant switching costs, as businesses rely on their integrated solutions for critical operations, making it challenging to switch to a competitor.

Understanding these additional moats can provide a more comprehensive view of a company's potential for sustained competitive advantage and long-term growth.

Red Flags in Business Models

Be vigilant for these warning signs when evaluating a pre-IPO company:

Over-reliance on a Single Customer or Sector: If a large percentage of revenue comes from one customer or a narrow market segment, it presents a risk.

Rule of Thumb: No single customer should account for more than 10-15% of total revenue.

Unsustainable Customer Acquisition Strategies: Be wary of companies heavily dependent on discounting or unsustainable marketing spend.

Example: Many food delivery startups struggled with profitability due to heavy discounting and high customer acquisition costs.

Regulatory Uncertainties: For companies operating in highly regulated industries or pushing regulatory boundaries, understand the potential risks.

Case Study: Cryptocurrency exchanges face ongoing regulatory challenges that can significantly impact their business models.

Frequent Pivots: Multiple significant changes in business model or target market can indicate a lack of clear direction.

Exception: Early-stage startups may pivot as they find product-market fit, but later-stage companies should have a stable direction.

Opaque Financials: If the company is hesitant to share basic financial metrics, it could be a red flag.

What to Look For: Transparent communication about key metrics, even if the numbers aren't perfect.

Understanding Funding History and Valuation

The timing and terms of a company's last fundraise can provide crucial insights into its financial health and future prospects:

ZIRP Era Overvaluation: Companies that raised significant funds during the Zero Interest Rate Policy (ZIRP) era (roughly 2008-2022) may be overvalued and struggling to grow into their valuations.

Red Flag: A company that raised at a high valuation in 2021 but hasn't shown significant growth since then may be overvalued.

Recent Bridge Rounds: Bridge rounds, especially if not publicly disclosed, can indicate financial distress.

What to Ask: "Has the company raised any capital since its last publicly announced round?"

Liquidation Preferences: Recent rounds, especially bridge rounds, may come with high liquidation preferences that can negatively impact employee equity in exit scenarios.

Key Point: High liquidation preferences (e.g., 2x or 3x) mean investors get paid out before employees in an exit event.

Valuation vs. Reality: Even if a company maintains its high valuation on paper, the reality might be different. Look at revenue multiples, growth rates, and unit economics to get a more accurate picture.

Strategy: Compare the company's metrics to publicly traded peers in the same sector.

Secondary Market Activity: If available, secondary market data can provide insights into how investors value the company.

Resources: Platforms like Forge Global or EquityZen sometimes offer data on private company stock transactions.

By thoroughly evaluating these aspects, you'll gain a clearer picture of the company's current position and future potential. Remember, your goal is not just to join a pre-IPO company, but to join one with strong fundamentals and genuine potential for success.

Investor Sentiment: The Market's Mood Matters

While the financial health of a company is critical, investor sentiment around a company's sector, market, or business model can be just as influential in determining its success. The following examples illustrate how shifts in investor sentiment can impact a company's prospects:

e.g. Generative AI (GenAI): In recent years, Generative AI has captured significant investor interest. Companies operating in this space have seen increased valuations and funding opportunities, even if their business models are still evolving.

The surge in interest around AI technologies has led to higher valuations for companies like OpenAI and Anthropic. Investors are willing to bet on the future potential of AI, driving up the market value of these firms.

e.g. SaaS vs. D2C: Software as a Service (SaaS) companies have remained in favor due to their scalable business models and recurring revenue streams. In contrast, Direct-to-Consumer (D2C) companies, once the darlings of the investment world, have fallen out of favor due to high customer acquisition costs and thin margins.

SaaS companies like Salesforce and ServiceTitan continue to attract strong investor interest, while many D2C brands like Harry’s struggle to maintain their valuations and secure funding.

Timing Matters: Tight IPO Windows

e.g. Edtech’s short IPO window

Edtech companies Udemy and Coursera both went public in 2021, but now their stocks have contracted and all the education companies that did not go public during that window are struggling to live up to their valuation. They are getting acquired or raising at lower valuations, making an IPO unlikely.

Understanding the broader market sentiment can provide valuable context when evaluating a pre-IPO opportunity. It's crucial to consider not only a company's internal metrics but also how its sector and business model are perceived by the investment community at any given moment.

5. Decoding Equity Compensation: The Pre-IPO Wealth Puzzle

Equity compensation is often the most alluring—and complex—part of a pre-IPO job offer. Understanding the nuances can help you accurately value your potential compensation package and make informed decisions.

Note: I highly recommend ’s book, The Startup Lottery on this topic.

Types of Equity

Stock Options: Stock options give you the right to buy company stock at a set price (the "strike price") in the future.

Two main types:

Incentive Stock Options (ISOs): Offer potential tax benefits but are only available to employees.

Non-Qualified Stock Options (NSOs): Can be granted to non-employees and have different tax treatment.

Key Concept: "Strike Price" - the price at which you can exercise your options to buy shares.

Example Calculation: Let's say you're granted 10,000 options with a strike price of $2 per share. If the company goes public at $20 per share, your potential profit would be: (Market Price - Strike Price) x Number of Options = ($20 - $2) x 10,000 = $180,000 (before taxes)

Restricted Stock Units (RSUs): RSUs are a promise to grant stock after certain conditions are met, usually a vesting period.

Important Note: RSUs are more common in later-stage startups and typically don't require you to purchase shares.

Example: You're granted 5,000 RSUs that vest over 4 years. If the share price at vesting is $15, the value of your vested RSUs each year would be: (5,000 / 4) x $15 = $18,750 per year (before taxes)

Valuation Dynamics

Understanding how your equity is valued is crucial:

409A Valuations:

This is the company's official valuation for tax purposes, typically lower than the last funding round valuation.

Why It Matters: A low 409A relative to the last funding round could be beneficial for option grants, as it results in a lower strike price.

Example: Company's last funding round valuation: $1 billion 409A valuation: $500 million Your option strike price will be based on the $500 million valuation, potentially leading to greater upside.

Preferred vs. Common Stock (Preference Stack):

Most employees receive common stock, which is valued lower than the preferred stock given to investors.

Key Point: The valuation you hear about in the news is usually based on preferred stock prices and may not reflect the value of your common stock options.

Real-World Example: When Square (now Block) went public in 2015, its last private valuation was $6 billion, but it went public at a $2.9 billion valuation. This discrepancy was partly due to the difference between preferred and common stock values.

Dilution:

As companies raise more funding, your ownership percentage may decrease.

Rule of Thumb: Expect 20-30% dilution between major funding rounds.

Calculation Example: You own 0.1% of the company. After a new funding round with 25% dilution: Your new ownership = 0.1% x (1 - 0.25) = 0.075%

Vesting Schedules

Vesting schedules determine when you gain full ownership of your equity.

Standard Schedule: 4 years with a 1-year cliff

What This Means:

You gain no vested shares in the first year (the "cliff")

After 1 year, 25% of your shares vest

The remaining 75% vest monthly over the next 3 years

Example: You're granted 48,000 options on a 4-year vesting schedule with a 1-year cliff.

At 1 year: 12,000 options vest

Each month after: 1,000 options vest

Liquidation Preferences

Liquidation preferences determine the order and amount in which different stakeholders get paid in a liquidation event (like an acquisition or IPO).

Why It Matters: Strong liquidation preferences for investors can significantly reduce the value of common stock in certain exit scenarios.

Example: A company sells for $100 million. Investors have a 2x liquidation preference on their $60 million investment.

Investors get: $120 million (2 x $60 million)

Common stockholders get: $0 (since the sale price was less than the liquidation preference)

Case Studies in Equity Structures: Rippling vs. Stripe

To illustrate the diversity of equity compensation approaches in the pre-IPO world, let's compare two prominent companies:

Rippling's Approach:

Offers a mix of ISOs and RSUs, with RSUs becoming more prevalent as the company's valuation increased

Maintains a relatively low 409A valuation compared to its preferred stock price, potentially offering employees more upside on their options

Known for offering generous equity packages to attract top talent

Key Takeaway: Rippling's approach aims to provide significant upside potential to employees, aligning their interests closely with the company's growth.

Stripe's Approach:

Provides annual RSU grants based on a dollar value rather than a specific number of shares

This approach protects employees from downside risk – if the company's valuation decreases, the employee would receive more shares to meet the promised dollar value

Offers regular liquidity opportunities through tender offers, allowing employees to sell a portion of their vested equity periodically

Key Takeaway: Stripe's approach provides more predictable value and regular liquidity opportunities, but potentially less upside compared to traditional equity structures.

Implications for Employees:

Risk Tolerance: Rippling's structure might appeal more to risk-tolerant employees betting on significant company growth. Stripe's structure could be attractive to those preferring stability and predictable value.

Career Stage: Early-career professionals might be more willing to take the risk associated with Rippling's approach, while those with more financial responsibilities might prefer Stripe's stability.

Financial Planning: Stripe's regular liquidity events through tender offers allow for easier financial planning and diversification.

Negotiation Strategies

Note: If you are in the job search, I offer job offer negotiation coaching for tech and product leaders and senior ICs.

For Early Stage, Focus on the Number of Shares, Not Just the Percentage:

Percentage ownership can be misleading due to dilution from future funding rounds.

The absolute number of shares owned is crucial, as their value can increase significantly with company growth.

Early-stage companies’ valuations can increase over time faster than your percentage ownership decreases, making even small ownership stakes valuable.

Understand Vesting Schedules: Typical is 4 years with a 1-year cliff, but some companies offer more favorable terms.

One-Year Vesting: Some startups offer a one-year vesting schedule to attract talent quickly. For example, a company might vest 100% of the shares after one year to incentivize short-term commitment.

Front/Back-Weighted Vesting: In front-weighted vesting, a larger percentage of shares vest in the early years, such as 40% in the first year and the remaining 60% over the next three years. Conversely, back-weighted vesting might vest 10% in the first year and 90% over the remaining years. This approach can be seen in companies looking to retain employees long-term.

Vesting Grants Based on Cash: Instead of a set number of shares, some companies grant equity based on a cash value. For example, a company might offer $100,000 worth of shares vesting over four years. If the share price increases, the number of shares decreases, and vice versa. This can be advantageous in volatile markets.

Look for Refresh Grants: Ask about the company's policy on granting additional equity over time. Some companies do this annually, some have no refreshers, and others base it on performance.

Negotiate for Longer Exercise Windows: If leaving the company, standard windows to exercise vested options are often short (90 days). Longer windows (several years) are more employee-friendly and don’t force you to drop a lot of cash you may not have in fear of losing out on exercising risky stock options.

Cashless exercise: My extended 3-year exercise window at Udacity allowed me to sell my shares on the secondary markets at the same time as exercising (cashless exercise) when the prices were at their peak, reducing risk and increasing my gain.

Consider the Current Valuation: If joining a company that recently raised at a high valuation, try to negotiate a lower strike price based on a more conservative valuation.

Remember, while equity can be a powerful wealth-creation tool, it's essentially a lottery ticket until a liquidity event occurs. Base your career decisions on more than just the promise of equity riches, and always consider the total compensation package and career growth opportunities.

6. Assessing Exit Potential

Understanding a company's potential for a successful exit is crucial when evaluating pre-IPO opportunities. Whether through an IPO or acquisition, the exit event is typically when employees can realize significant value from their equity. Here's what you need to consider:

IPO Readiness Factors

1) Financial Metrics:

Revenue: Many investment bankers now suggest a minimum of $100 million in annual recurring revenue (ARR) for a successful IPO. Note: Lately, some have suggested that $1 billion in annual revenue is the new benchmark

Growth Rate: Aim for companies growing at least 30-50% year-over-year. The growth has to be stable, too. Bankers will usually look for 4-8 consecutive quarters of revenue growth.

Profitability: While not always necessary (think Uber or Lyft), a clear path to profitability is increasingly important.

Example: Databricks reported over $1 billion in revenue for 2023 and has been growing at over 50% annually, making it a strong IPO candidate.

2) Market Conditions:

Overall economic climate

Sector-specific trends

Investor appetite for new issues

Case Study: The 2023 IPO drought was largely due to unfavorable market conditions, with high interest rates and economic uncertainty making investors wary of new public offerings.

3) Competitive Position:

Market leadership or unique value proposition

Defensible technology or business model

4) Management Team:

Experienced leadership with public company experience

Strong financial controls and reporting capabilities

5) Corporate Governance:

Board composition

Financial audits and compliance measures

Red Flag: If a company has been "IPO ready" for years without making the leap, investigate why. It could indicate internal issues or an unfavorable assessment of market receptivity.

M&A Possibilities

While IPOs grab headlines, acquisitions are often a more common exit route for startups. However, the M&A landscape has its own complexities:

Current M&A Trends:

According to Carta data, about 150 companies were acquired in Q2 2024, relatively flat compared to previous quarters.

Roughly half of M&A activity involves pre-seed or seed companies, suggesting many are acquihires or feature acquisitions rather than major tie-ups.

Implication: The much-anticipated surge in M&A activity following the tech downturn hasn't fully materialized.

Sector-Specific M&A Activity:

Some sectors, like AI and cybersecurity, are seeing more M&A interest.

Consumer tech M&A has been slower, with buyers being more selective.

Potential Acquirers:

Look at who the natural acquirers would be in the company's space.

Consider whether the company has strategic partnerships that could lead to acquisition.

Impact on Employees:

Understand how different M&A scenarios might affect your equity.

Consider potential job security implications in case of an acquisition.

Case Study: Microsoft's acquisition of Activision Blizzard for $68.7 billion in 2023 took over 18 months to close due to regulatory scrutiny. While it offered a 45% premium to shareholders, it also brought prolonged uncertainty for employees.

Failed Adobe x Figma Acquisition: Regulators recently led Adobe to cancel it’s acquisition of Figma for $20 billion, costing Adobe $1 billion in cash and countless more costs during the long process.

Large tech companies are thinking twice before acquiring now.

Liquidity Without an Exit: Tender Offers & Secondary Markets

As a tech employee holding equity, you don't always have to wait for an IPO or acquisition to gain liquidity. Two common alternatives are tender offers and secondary markets. Here's how they work, along with examples and constraints:

Tender Offers

Definition: A tender offer is a company-initiated process where employees and early investors can sell their shares back to the company or to approved third-party buyers.

How It Works:

The company sets the terms, including the price per share and the total number of shares they are willing to buy.

Employees can choose to sell some or all of their vested shares during the offer period.

Example:

Airbnb: Before going public, Airbnb conducted several tender offers to provide liquidity to its employees. These offers allowed employees to sell a portion of their shares at a pre-determined price, often based on the company's latest valuation.

Constraints:

Limited windows: Tender offers are not available all the time; they usually occur at specific intervals.

Price control: The company sets the price, which may be lower than the market value.

Participation limits: There may be restrictions on the number of shares you can sell.

Secondary Markets

Definition: Secondary markets are platforms where employees and investors can buy and sell shares of private companies before an IPO.

How It Works:

Platforms like EquityZen, Forge Global, and Notice facilitate these transactions.

Employees list their shares for sale, and interested buyers can purchase them at an agreed-upon price.

Example:

Palantir: Before its direct listing, Palantir shares were actively traded on secondary markets. Employees were able to sell their shares to private investors, providing liquidity well before the company went public.

Constraints:

Approval: Companies often require board approval for secondary transactions to ensure control over their cap table.

Pricing: Prices can vary widely based on demand and the perceived value of the company.

Market access: Not all private companies are listed on secondary markets, limiting your options.

Key Considerations for Employees

Tax Implications:

Selling shares can trigger tax liabilities, including capital gains tax.

Consult with a tax advisor to understand the implications of any sale.

Dilution:

Keep in mind that selling shares can dilute your ownership percentage, especially in the case of tender offers where new shares may be issued.

Future Upside:

Selling shares early can provide liquidity but may limit your potential upside if the company's value increases significantly post-IPO or acquisition.

By understanding these options, you can make informed decisions about when and how to sell your equity, balancing the need for liquidity with the potential for future gains.

The "Zombie Unicorn" Phenomenon

The term "Zombie Unicorn" refers to companies valued at over $1 billion that are struggling to grow into their valuations or secure additional funding. This is a crucial concept to understand when evaluating pre-IPO opportunities:

Characteristics of Zombie Unicorns:

Stagnant or declining revenue growth

Difficulty raising new funding at higher valuations

Multiple rounds of layoffs

Pivots in business model or strategy

Delayed or canceled plans for going public

Risks for Employees:

Devalued equity: As the company's prospects dim, so does the value of your equity.

Job insecurity: Zombie unicorns often go through multiple restructuring phases.

Career stagnation: Limited resources can hinder professional growth and development.

How to Identify Potential Zombie Unicorns:

Look for companies that haven't raised new funding in 2-3 years in a bull market.

Be wary of companies that have had multiple down rounds or bridge financings.

Investigate companies that have delayed IPO plans multiple times without clear reasons.

Mitigation Strategies:

Diversify your portfolio: Don't put all your eggs in one pre-IPO basket. If you can get exposure to other stocks, sell your shares in tender offers or secondary markets, or find other ways to diversify, take those shots.

Stay informed: Keep track of your company's financial health and market position.

Have an exit strategy: Know when you might need to consider other opportunities.

The VC Debate: Private vs. Public

There's an ongoing debate in the venture capital world about whether companies should stay private longer or go public earlier. This debate has significant implications for employees:

The "Stay Private Longer" Camp (e.g., Marc Andreessen of a16z):

Argument: Staying private allows companies to focus on long-term strategy without the pressures of quarterly earnings.

Impact on Employees: Potentially larger equity upside, but longer wait for liquidity.

The "Go Public Earlier" Camp (e.g., Bill Gurley of Benchmark):

Argument: Public markets provide discipline, transparency, and liquidity.

Impact on Employees: Earlier liquidity opportunities, but potentially less equity upside.

Current Trend: The pendulum is swinging back towards earlier public offerings, but with a higher bar. Many now say companies need $1 billion in revenue and a $10 billion valuation to be IPO-ready.

Implication for You: When evaluating a pre-IPO opportunity, consider the company's stance on this debate and how it aligns with your personal financial goals and risk tolerance.

7. Liquidity Events and Employee Considerations

Understanding the various paths to liquidity is crucial for maximizing the value of your pre-IPO equity. Here's what you need to know:

Lockup Periods for Employee Equity

Understanding lockup periods is crucial for employees holding equity in pre-IPO companies. A lockup period is a predetermined time frame after an IPO during which employees and insiders are restricted from selling their shares. This period is typically 180 days but can vary depending on the company's policies and agreements with underwriters.

Key Points to Consider:

What is a Lock-up Period?

A set timeframe (typically 180 days) after an IPO during which employees and early investors cannot sell their shares.

Designed to prevent a flood of shares hitting the market immediately after IPO.

Impact on Employees:

You can't immediately cash out your equity when the company goes public.

The stock price can fluctuate significantly during and after the lock-up period.

Purpose of Lockup Periods:

Lockup periods are designed to prevent a sudden flood of shares into the market, which could destabilize the stock price shortly after the IPO.

They provide a buffer period for the market to absorb the new stock and for the company to establish its post-IPO trading pattern.

Typical Lockup Periods for Tech IPOs:

For most tech companies, the lockup period is usually around 180 days.

However, it can vary; some companies may have shorter or longer lockup periods based on their agreements with underwriters.

Impact on Employees:

Employees may see the value of their equity fluctuate during the lockup period but will be unable to sell their shares to capitalize on favorable price movements.

It's essential to plan financially, knowing that you won't have immediate liquidity for your shares post-IPO.

Examples of Companies Without Traditional Lockup Periods: Direct Listings

Spotify: When Spotify went public through a direct listing in 2018, there was no traditional lockup period. This allowed employees and early investors to sell their shares immediately, leading to a different dynamic in the stock's early trading days.

Slack: Similarly, Slack chose a direct listing for its public debut in 2019, bypassing the traditional lockup period. This provided immediate liquidity for employees and early investors.

Direct Listings vs IPOs: IPOs raise new capital and involve underwriters with a lockup period, while direct listings do not raise new capital, have no underwriters, and typically no lockup period.

Strategic Considerations:

Be aware of the lockup expiration date, as stock prices often experience increased volatility around this time due to the sudden availability of shares.

Consider consulting with a financial advisor to strategize the optimal time to sell your shares post-lockup, balancing market conditions and personal financial goals.

Strategies for Managing Lock-up Periods:

Diversification planning: Prepare a strategy for when you can sell shares.

Dollar-cost averaging: Plan to sell shares gradually over time rather than all at once.

Tax planning: Consult with a financial advisor to understand tax implications of selling post-lock-up.

Employees left holding the bag after lockup periods

When Facebook (Meta) went public in 2012, its 180-day lockup period led to significant stock price fluctuations as large volumes of shares were released into the market.

Uber’s stock price dropped to about $27 per share six months after its IPO when the 180-day lock-up period ended. Employees had to pay income taxes based on the $45 IPO price, even though they couldn't sell at that price.

Understanding lockup periods can help you manage expectations and make informed decisions about your equity compensation, ensuring you maximize the potential value of your shares.

Secondary Markets and Their Limitations

Secondary markets allow employees to sell shares before a company goes public, but they come with limitations:

Platforms:

EquityZen, Forge Global, and SharesPost are popular secondary market platforms.

Benefits:

Provide some liquidity before an IPO or acquisition.

Allow diversification of personal portfolio.

Limitations:

Often restricted by companies.

May require company approval for each transaction.

Typically sell at a discount to the last private valuation.

Can have complex tax implications.

Case Study: Airbnb Prior to its IPO, Airbnb allowed employees to sell up to 15% of their vested equity on secondary markets, providing some liquidity while the company remained private.

Tender Offers: A Deeper Dive

Tender offers are becoming an increasingly common way for pre-IPO companies to provide liquidity to employees:

What is a Tender Offer?

A structured event where the company or an outside investor offers to buy shares from current shareholders.

Benefits:

Provides partial liquidity without waiting for an IPO.

Often done at a known price, reducing uncertainty.

Considerations:

May be offered at a discount to potential IPO value.

Often limited in size and frequency.

May have tax implications.

Example: Stripe's Approach Stripe has been known to conduct regular tender offers, allowing employees to sell a portion of their vested equity. This approach provides predictable liquidity events and helps retain talent.

What to Ask About Tender Offers:

Frequency: How often does the company conduct tender offers?

Eligibility: Who can participate, and are there any restrictions?

Pricing: How is the price determined?

Limits: Are there caps on how much you can sell?

Strategies for Managing Equity Post-IPO

Once your company goes public, you'll need a strategy for managing your newly liquid equity:

Diversification:

Consider selling a portion of your shares to diversify your portfolio.

The "5-10-15" rule: Some advisors suggest not having more than 5% of your portfolio in any single stock, 10% in your company's stock, and 15% in your industry.

Dollar-Cost Averaging:

Sell shares gradually over time to mitigate the risk of market timing.

Tax Planning:

Understand the tax implications of selling shares (e.g., capital gains tax).

Consider strategies like tax-loss harvesting or charitable giving of appreciated shares.

Long-term Holding:

If you believe in the company's long-term prospects, consider holding a portion of your shares.

Employee Stock Purchase Plans (ESPPs):

If your company offers an ESPP post-IPO, consider participating as it often provides discounted stock purchases.

Remember, every situation is unique. It's often wise to consult with a financial advisor who can help you create a personalized strategy aligned with your overall financial goals.

In the next section, we'll explore how to navigate company culture and employee treatment in pre-IPO companies, which can significantly impact your overall experience and success in these high-pressure environments.

8. Navigating Company Culture and Employee Treatment

The allure of pre-IPO companies often overshadows the realities of working in these high-pressure environments. Understanding and evaluating company culture is crucial for your long-term satisfaction and success.

Analyzing Culture Beyond the Perks

Work-Life Balance:

Many pre-IPO companies demand long hours and high stress levels.

Ask about typical work hours, weekend work expectations, and vacation policies.

Growth Opportunities:

Look for companies that invest in employee development.

Ask about career progression paths and internal promotion rates.

Decision-Making Processes:

Understand how decisions are made and how much autonomy employees have.

Look for transparency in communication from leadership.

Diversity and Inclusion:

Evaluate the company's commitment to building a diverse and inclusive workplace.

Look for diversity in leadership positions.

Values Alignment:

Ensure the company's mission and values align with your own.

Look for evidence that the company lives its stated values.

Red Flag: If the company can't articulate its culture beyond perks like free meals or game rooms, it may indicate a lack of intentional culture-building.

Case Studies of Controversial Practices

Stripe and Rippling: Intensity and Fast Firing

Known for intense work environments and high performance expectations.

Reports of quick terminations for underperformance.

Implication: While these practices can drive innovation and efficiency, they can also lead to burnout and job insecurity.

Databricks and OpenAI: High Compensation, Low Work-Life Balance

Offer competitive compensation packages but often demand long hours.

Employees report high-pressure environments with significant workloads.

Trade-off: The potential for significant financial rewards comes at the cost of work-life balance.

Turo: Smaller Scale, Better Work-Life Balance

Reports indicate a more balanced approach to work hours and employee well-being.

Compensation may be lower compared to high-growth unicorns.

Consideration: For some professionals, the trade-off of lower potential upside for better quality of life may be worthwhile.

Effective Research and Backchannel Strategies

Why You Should Research and Backchannel Companies

Researching and backchanneling companies are crucial steps in vetting potential employers, particularly pre-IPO companies. Here's why:

Assessing Stability and Growth:

Researching financial health and growth prospects can help you gauge the company's stability and potential for success.

Backchanneling can reveal unpublicized challenges or concerns, helping you make a more informed decision about the company's future.

Evaluating Leadership:

Strong leadership is critical for a company's success. Researching and backchanneling can provide insights into the leadership team's experience, vision, and track record.

Poor leadership can lead to strategic missteps, affecting the company's growth and your job security.

Understanding Market Position:

Investigate the company's competitive landscape and market share. A company with a strong market position is more likely to succeed and attract investors.

Backchanneling can provide insights into how the company is perceived in the industry and its ability to innovate and stay ahead of competitors.

Identifying Red Flags:

Online reviews and backchannel conversations can highlight potential red flags, such as high turnover rates, poor management practices, or unrealistic expectations.

Identifying these issues early can save you from joining a company that may have underlying problems affecting its long-term success.

The Importance of Reverse Interviewing

Reverse interviewing is the process of asking potential employers questions to assess if the company is a good fit for you. Here's why it's important in evaluating the company's probability of success:

Clarifying Business Strategy:

Asking questions about the company's business strategy, product roadmap, and growth plans can help you understand its long-term vision and viability.

Understanding how the company plans to achieve its goals can give you confidence in its potential for success.

Evaluating Financial Health:

Inquiring about recent funding rounds, revenue growth, and profitability helps you assess the company's financial health and stability.

Financial stability is crucial for job security and the potential for the company to go public or be acquired.

Gaining Insight into Company Challenges:

Inquiring about the biggest challenges the company is facing can provide insights into potential risks and areas of uncertainty.

Understanding these challenges helps you prepare for the realities of the job and assess whether the company has a plan to overcome them.

By conducting thorough research, backchanneling, and reverse interviewing, you can make a more informed decision about joining a pre-IPO company. These steps help ensure that the company has a strong foundation and a realistic path to success, ultimately increasing your chances of benefiting from its growth and potential public offering or acquisition.

Leverage Your Network:

Use LinkedIn to find current or former employees (ones that left for better opportunities who are less likely to be salty)

Reach out for informal conversations about their experiences.

Analyze Online Reviews:

Check platforms like Glassdoor and Blind, but be aware of potential biases.

Look for patterns in reviews rather than focusing on individual comments.

Ask Thoughtful Questions During Interviews:

"Can you describe a typical day for someone in this role?"

"How does the company handle disagreements or conflicting viewpoints?"

"What's the biggest challenge the company is currently facing?"

Observe Interactions:

During onsite interviews, pay attention to how employees interact with each other.

Look for signs of collaboration, respect, and engagement.

Research Press Coverage:

Look for news articles about the company's workplace practices.

Pay attention to how the company responds to public criticism or challenges.

Analyze Employee Tenure:

High turnover rates, especially in key positions, can be a red flag.

Use LinkedIn to gauge how long employees typically stay with the company.

Remember, while no company is perfect, it's crucial to find a culture that aligns with your values and work style. Be honest with yourself about what you're willing to trade for the potential upside of a pre-IPO opportunity.

9. Legal and Financial Considerations

Navigating the legal and financial aspects of pre-IPO equity can be complex. Here are key considerations to keep in mind:

Key Clauses in Equity Agreements

Vesting Schedule:

Standard is four years with a one-year cliff, but terms can vary.

Tip for executives: Look for acceleration clauses in case of company sale or your termination without cause.

Exercise Window:

Standard is 90 days post-employment to exercise vested options.

Some companies offer extended exercise windows (e.g., 7-10 years), which can be highly beneficial.

Repurchase Rights:

Some companies retain the right to buy back vested shares if you leave.

Understand the terms and potential impact on your equity value.

Transfer Restrictions:

Most agreements restrict your ability to transfer or sell shares before an IPO.

Understand any exceptions, such as for estate planning purposes.

Information Rights:

Look for clauses that give you the right to receive financial information about the company.

This can be crucial for making informed decisions about your equity.

Red Flag: Be cautious of any unusual or overly restrictive clauses. If something seems off, consider having a lawyer review the agreement.

Tax Implications of Different Equity Structures

Incentive Stock Options (ISOs):

Potential for favorable tax treatment if certain holding periods are met.

Be aware of Alternative Minimum Tax (AMT) implications.

Non-Qualified Stock Options (NSOs):

Taxed as ordinary income at exercise, regardless of whether you sell the shares.

Can result in a significant tax bill if exercised when the company's valuation is high.

Restricted Stock Units (RSUs):

Taxed as ordinary income when they vest.

Often, some shares are automatically sold at vesting to cover tax obligations.

Early Exercise:

If allowed, can potentially result in more favorable tax treatment.

Requires upfront investment and carries risk if the company's value decreases.

Example: If you early exercise 10,000 options at $1 per share, you'd need to invest $10,000. If the company fails, you lose this investment.

83(b) Election:

Allows you to be taxed on the fair market value of stock at the time of grant rather than vesting.

Must be filed within 30 days of receiving the grant.

Can be beneficial if you expect the company's value to increase significantly.

When to Seek Professional Advice

Evaluating Job Offers:

Consider consulting a financial advisor when comparing complex compensation packages.

They can help you understand the potential value and risks of different equity offerings.

Tax Planning:

Consult a tax professional before exercising options or selling shares.

They can help you understand and plan for potential tax liabilities.

Legal Review:

Consider having a lawyer review your equity agreement, especially for executive-level positions.

This is particularly important if there are unusual clauses or if you're negotiating custom terms.

Financial Planning:

Work with a financial advisor to integrate your equity into your overall financial plan.

They can help with diversification strategies and risk management.

Approaching Liquidity Events:

Seek professional advice when your company is approaching an IPO or potential acquisition.

Experts can help you navigate lock-up periods, selling strategies, and tax implications.

Remember, while professional advice can be expensive, it can potentially save you significant money and headaches in the long run, especially when dealing with large amounts of equity.

Key Takeaway: Don't be afraid to ask for help. The complexities of pre-IPO equity often warrant professional guidance, especially as the potential value of your equity increases.

In the next section, we'll explore future trends shaping the pre-IPO landscape and strategies for long-term career resilience in this dynamic environment.

10. Future Outlook: Trends Shaping the Pre-IPO Landscape

The pre-IPO landscape is constantly evolving. Understanding emerging trends can help you make more informed career decisions and better navigate this dynamic environment.

Potential Regulatory Changes

SEC Scrutiny on Private Markets:

Increased focus on transparency and investor protection in private markets.

Potential new rules on reporting requirements for large private companies.

Implication: This could lead to more transparency for employees but might also make it harder for companies to stay private for extended periods.

Changes to Equity Compensation Rules:

Discussions around extending the timeline for exercising options post-employment.

Potential changes to tax treatment of equity compensation.

What to Watch: Keep an eye on proposed legislation that could affect how your equity is taxed or your ability to exercise options.

Cryptocurrency and Blockchain Regulations:

Evolving regulations around crypto assets and blockchain technology.

Could affect companies in the fintech and blockchain spaces.

Example: The outcome of the SEC's lawsuit against Ripple could have far-reaching implications for companies using blockchain technology.

Emerging Trends in Company Formation and Funding

Rise of Alternative Funding Models:

Increased use of revenue-based financing and other non-dilutive funding options.

Growth of venture debt as an alternative to equity financing.

Implication: These trends could lead to different equity structures and potentially less dilution for early employees.

Democratization of Startup Investing:

Growth of platforms allowing retail investors to invest in pre-IPO companies.

Potential for more liquidity options for employees.

Example: Companies like Carta are working on creating more efficient secondary markets for private company shares.

Focus on Sustainable Growth:

Shift away from the "growth at all costs" mentality.

Increased emphasis on unit economics and path to profitability.

What It Means for You: Companies with sustainable business models may offer more stable long-term prospects, even if they lack the explosive growth of some unicorns.

Remote-First Companies:

Continuation of the remote work trend, even post-pandemic.

Rise of "headquarterless" companies and distributed teams.

Career Implication: This could open up opportunities to work for exciting pre-IPO companies regardless of your location.

11. Career Planning In Pre-IPO Companies

Chaos Is A Ladder

The fact that Pre-IPO companies go through more frequent and volatile ups and downs means that there is more turnover at the top and more opportunities to lead or gain scope as teams and businesses grow and get added.

The “chaos” of the hypergrowth company life is an opportunity to advance in your career and prove yourself well before a big tech company would give you the reins.

Yo-Yo Strategy

(ex-VP Product at Meta, ex-CPO at Credit Karma) suggests a strategy of moving back and forth between large public tech companies and earlier stage or growth companies in your career. When you move to growth-stage Pre-IPO companies, even if you don’t liquidate your equity, you can gain a larger scope, move up the seniority ladder much faster, and often come back to the FAANG+ companies at a higher level than if you had waited for promo.

When you move to a big tech job, you get exposure to how things are done at large scale in large organizations. Plus, you are often surrounded by top talent. When you go back to growth stage companies, it will often be in a higher seniority role and you will bring a brand and a network along with you.

12. Conclusion: Making Informed Decisions in the Pre-IPO World

Navigating the pre-IPO landscape as a tech professional can be both exciting and daunting. The potential for significant financial upside and career growth is balanced by increased risk and uncertainty. As we've explored throughout this guide, making informed decisions requires a nuanced understanding of various factors:

Key Takeaways

Due Diligence is Crucial:

Thoroughly research the company's financials, market position, and growth prospects.

Understand the terms of your equity compensation and its potential value.

Culture Matters:

Look beyond perks to understand the company's values and work environment.

Ensure the culture aligns with your own values and work style.

Equity is Not Guaranteed Wealth:

Understand the risks and potential outcomes of your equity compensation.

Don't make life decisions based solely on the paper value of your equity.

Stay Informed and Adaptable:

Keep up with industry trends and regulatory changes.

Continuously develop your skills to maintain career resilience.

Seek Professional Advice:

Don't hesitate to consult financial advisors, tax professionals, or lawyers when dealing with complex equity situations.

Balancing Opportunities and Risks

Joining a pre-IPO company is often a high-risk, high-reward proposition. Here's how to approach the decision:

Assess Your Risk Tolerance:

Be honest with yourself about how much uncertainty you're comfortable with.

Consider your current life stage and financial obligations.

Evaluate the Total Package:

Look at base salary, benefits, work-life balance, and growth opportunities, not just equity.

Understand how the role fits into your long-term career goals.

Diversify Your Career Portfolio:

Consider mixing experiences at different stages of companies throughout your career.

Balance high-risk opportunities with periods of stability.

Trust Your Instincts:

If something feels off during the interview process or in your research, don't ignore it.

Remember that no amount of potential upside is worth compromising your well-being or values.

Final Thoughts on Navigating Your Tech Career

The pre-IPO world offers unique opportunities for tech professionals to join high-growth companies. Here are specific areas to focus on for making informed decisions:

Key Considerations:

Equity Package Details:

Vesting Schedules: Typically, four years with a one-year cliff. Executive-level candidates should look for acceleration clauses in case of termination without cause or company sale.

Exercise Windows: Standard is 90 days post-employment. Extended windows (e.g., 7-10 years) are highly beneficial.

Tax Implications: Understand the tax consequences of ISOs, NSOs, and RSUs. For example, ISOs can trigger AMT, while NSOs are taxed as ordinary income upon exercise.

Company Financial Health:

Revenue and Profitability: Examine the company's financial statements or any available data on revenue growth and profitability.

Funding Rounds: Investigate recent funding rounds and investor profiles. Strong backing from reputable VCs can be a good indicator.

Burn Rate: Understand how fast the company is burning through its cash reserves. A high burn rate without a clear path to profitability can be a red flag.

Investor Interest: Track how investors treat companies with that sector, business model, and market. How likely will they be able to raise capital at favorable terms?

Leadership and Vision:

Executive Team: Research the backgrounds of key leaders. Look for a track record of successful ventures and clear, transparent communication.

Company Roadmap: Ask about the product roadmap and strategic vision. A well-thought-out plan for growth and market capture is crucial.

Work Environment:

Work Hours: Clarify expectations around work hours and weekend work. High-intensity environments may not suit everyone.

Employee Turnover: High turnover can indicate deeper issues. Use LinkedIn to gauge the average tenure of employees in key positions.

Professional Advice:

Legal Review: Have a lawyer review your equity agreement, especially if there are unusual clauses. This is crucial for executive-level positions.

Financial Planning: Work with a financial advisor to integrate your equity into your overall financial plan. Diversification is key to managing risk.

Industry Trends:

Regulatory Changes: Stay updated on potential changes in SEC regulations affecting private companies. Increased transparency requirements can impact company operations.

Market Position: Analyze the company's competitive landscape. Companies with a strong market position are more likely to succeed and attract investors.

Wrap-Up:

Navigating the pre-IPO landscape requires a strategic approach. By focusing on these key considerations, you can make well-informed decisions that balance potential financial gains with personal and professional factors.

Remember, your career is a marathon, not a sprint. Each decision should support your long-term growth and well-being. Stay adaptable and informed, continuously update your skills, and seek professional advice when needed.

Beautiful and thorough overview. Thanks for sharing

Will include it for our readers in tomorrow’s blog.

This is gold Colin. 👏