5 reasons not to work for a startup

The Startup Lottery author and 30-year startup veteran helps you decide whether to join a startup with open eyes.

Hey, Colin here! In this guest edition, we get to hear from the author of The Startup Lottery: Your Guide To Navigating Risk And Reward, Gus Bessalel, who has 30 years of experience in the ups and downs of working for startups as both an employee and founder.

The Startup Lottery is the book I wish I had read (and shared with colleagues) in my own decade of startup experience. I had to learn the ins and outs of startups, risk vs. reward, equity, and acting like an investor sporadically over the years - often the hard way. Now there is a guidebook for anyone considering or already working at a startup.

Comment with your questions for Gus and I may just ask him in our upcoming podcast interview.

This is Part 1 in a series of articles helping you decide whether to join tech companies at earlier or later stages. I also spent my career in private companies despite multiple opportunities to join big tech and will be sharing my own experiences in future posts.

Q: I am considering joining a startup after my time in Big Tech. I know it’s risky, but the upside sounds great, too. What are the real risks and chances of this turning out well for me?

When my last company was acquired, I moved into my “funemployment” phase after 30 years as a startup veteran. Our last round investors realized a 7x return after just 9 months, while for the employees, some who had been there for 6 or 8 years, the payouts on their options were relatively modest. That stark imbalance and the real risk of startup careers was something that many startup joiners don’t fully grasp. There was no comprehensive resource to explain the risks of startups and how their rules are written to benefit investors. So I wrote one.

My recently published book, The Startup Lottery, set out to provide a realistic picture of startup dynamics and how they affect employees. There is excessive hype about joining a startup and lots of press about the winners. But for every darling that graces the cover of Forbes, Inc. or Entrepreneur magazines, there are hundreds that bump along or worse, desperately try to find product market fit and attract their next venture round before they run out of money.

Together, my wife and I have spent 50 years in and around early-stage ventures. We’ve seen our share of startup successes and more than our share of failures as both employees and investors. Working in startups has many benefits but is rarely the path to instant millions, fame, or glory. It is critical to go in with your eyes open. If you are thinking about working in a startup, there are 5 reasons you might want to reconsider before you take the leap…

1: Most Startups Fail

…and It’s Worst for the Employees

After taking my first company to the Inc. 500, I co-founded my second company with the expectation that we’d have a huge blowout success. Then the Internet bubble burst, and we couldn’t get our Series B round done. After two rounds of layoffs, 91 of my friends and colleagues were out of jobs. I resigned from the board and gave up my contractual bonus to help fund severance. It was the most gut-wrenching experience of my young startup journey.

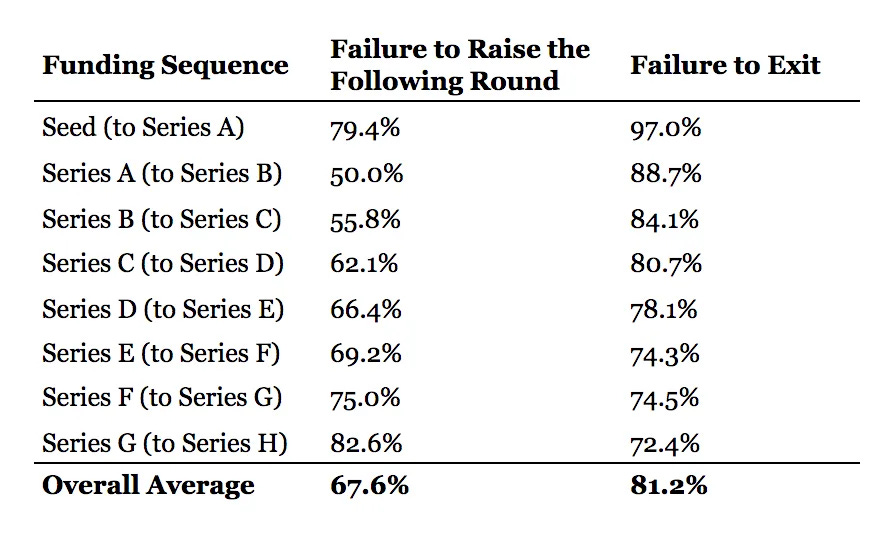

Look at the statistics. Fewer than 2 percent of startups are successful in attracting venture capital. Among those that do, more than 75 percent fail to return that capital to their investors through an exit. If even the investors who have preferred shares with priority payouts don’t get fully paid, employees with options on common shares will be left empty-handed.

And according to Carta, only 28% of employees exercise their vested options when they leave their companies, so after years of toiling away, they literally walk away with none of the equity value they have built up. Add up all the percentages, and the odds of getting a payout as an employee are almost as low as winning the lottery–hence the name of my book!

Venture capitalists build their portfolio with the expectation that a quarter to a third of the companies they fund will fail, a third will build modest businesses with small returns, and the remainder will deliver outsized returns to compensate for the losers.

As an employee, you can’t diversify your career investment the way VCs diversify their financial investment. You only work for one company at a time. While a third of VC-backed companies may hit it big, how can you know which third? You can try to do due diligence on companies to improve your odds. But pick the wrong horse and you may spend years toiling away in a company that goes nowhere and leaves you with little to show.

2: Startups Are Unstructured

…and the Upward Path is Not Always Clear

Go work for a big company, and you’ll usually get training, established performance management systems, and significant HR support to manage your career progression. Startups often lack the administrative infrastructure to guide your journey and career advancement paths are not always open or clear. Resources are tight and management is busy trying to get customers and attract funding. Building out back-office HR processes, especially in the early stages, is low priority.

When you join a startup, you are thrown into the wilderness and expected to figure out your job with little guidance or support. If you like working in an unstructured environment, that can be fun and offer a lot of freedom to contribute in various ways. But the lack of formal HR processes can affect your advancement and compensation. This is especially true in relatively flat organizations where there is little room for upward mobility.

Often, the only way to advance in startup land is to switch companies. But doing so forces you to confront the issue of what to do with your hard-earned vested options. Do you fork over cash to the employer you just left or turn your back on a potential payout? My wife walked away from a significant equity stake in a company because it would have cost us $100,000 to exercise her options. Less than 3 years later, the company had a successful exit, and that equity would have been worth $3 million.

3: Leadership is Unpredictable

Every venture-backed company is shaped by the interplay and power dynamic between the founders and the investors, who often sit on the board of directors. Founders may possess the vision, but also have biases and don’t always have the skills and experience to lead their startup to a successful exit. Inexperienced founders can make bad decisions that waste time and money.

And then there are the investors. In the words of my VC friend Adam Dakin, “bad boards kill companies.” Lots of VCs have actually never run a business—many came from Wall St. jobs directly into investing. They are impatient to see fast progress and may demand the company follow paths that don’t make sense.

At my last company, a board member forcefully pushed the company to sell “what’s on the truck” before the product was ready. We hired 8 salespeople who were doomed to fail. Two years and more than $15 million dollars later, we had to lay most of them off.

4: Startups Don’t Pay as Well as Big Companies

The theory of startup compensation is that employees should take lower cash compensation in exchange for a piece of the action. Salaries among early-stage ventures can be 15 to 30 percent lower than at big tech companies. The exception may be later-stage ventures that have received significant VC funding and can afford to compete for top talent. But the exception proves the rule and they pay out most of that in equity. Most recent later-stage ventures have had major valuation drops, making that equity worth next to nothing for employees.

In addition to lower salaries, startups push more cash compensation into variable bonuses to make the compensation appear higher than it actually is. But in a company where the HR processes are not fully formed, payout on variable comp can be uncertain or may rely on approval by capricious boards. And if cash gets tight, variable comp is often the first budget item to get slashed.

5: Startup Equity Rarely Pays Off

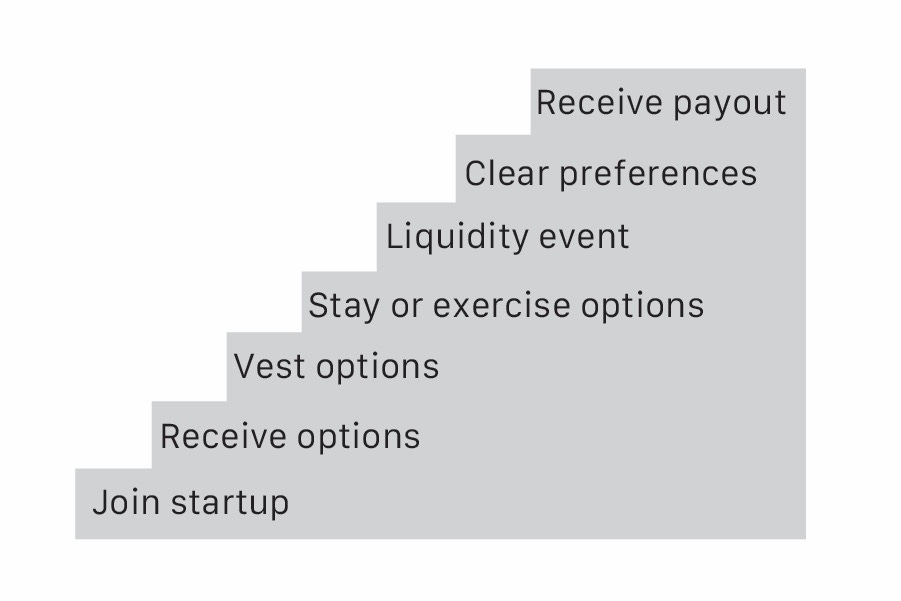

You are getting less cash, but you’re going to make it up with a large equity payout, right? Not so fast. As you can see in the illustration below from The Startup Lottery, it takes a lot to go right for employee stock options to be worth much.

First, you must receive a significant equity grant. Then, you must stay at the company long enough for the grant to vest. And finally, if you leave (which most startup employees do within 3 years), you forfeit the unvested portion of your grant. You must exercise the vested portion of your options (i.e., write a potentially large check to the company) within 90 days of leaving or forfeit that too. And even if you do all that, the company needs to realize an exit that is attractive enough for the investors to get repaid before you will see a nickel.

As an employee, you are a second-class citizen when it comes to reaping returns. Investors rule. Even if everything goes right, there’s no guarantee you’ll get a big payout. And when you consider startup failure rates, the low propensity of employees to exercise options when they leave, and the fact that investors have priority cash payouts on company exits, the odds of getting a large payout from startup equity become exceedingly small.

So Why Would People Work for Startups?

Despite all of these caveats, millions choose to work for startups. How does that make any sense? As I argue in The Startup Lottery, there are many great reasons. Assuming you’re going to get rich isn’t one of them. But here are some good reasons you should work for a startup. Just make sure you carefully consider what you are getting into and what you hope to get from the experience.

Visionary Founders and Executives - Founders often see the world as it should be. If they are right, they can help chart a path toward a better future. In small, flat organizations, even as a relatively junior employee, you will have much more exposure to these visionary leaders. You can learn from them as role models, engage with them as mentors, and develop them as sponsors and references who can help catapult you into increasingly senior roles at your company or elsewhere on your career journey. That rarely happens in big companies.

Committed Co-Workers – Visionary founders attract passionate, committed followers. talented and committed followers. In The Startup Lottery, I refer to startups as nonprofits with lottery tickets attached. Nobody goes to a nonprofit to get rich. They go because they believe in the good the nonprofit is doing for the world. That shared commitment can make for a great work experience as you find kindred spirits and all pull together to accomplish some audacious goals.

Varied Experience – Jobs in startups tend to be less defined. Talented employees are often thrown into a multitude of tasks. This provides a great opportunity to impact the organization in multiple ways, learn new skills, and gain recognition for being a go-to resource. This is especially true in early-stage startups that are in the “creative chaos” stage of development. You are helping to create light out of darkness, tackling multiple problems daily and weekly with creativity, resourcefulness, and persistence. It’s a great training ground that sharpens your ability to get thrown into tough situations and thrive.

Practice Your Startup Craft – The best way to learn how startups work is to work in one. Before I founded my first company, I worked in a small company and took on an internal role managing all administrative functions. It was completely different from my first company, but the skills I learned were invaluable when I took the plunge to go out on my own.

Startup life is not for the faint of heart. It’s not a path to instant millions. It is risky and can be disappointing and frustrating. But if you go in with clear expectations and an understanding of what you want to accomplish from your startup journey, it can be truly rewarding on a personal and professional level. It certainly was for me. And if you’re lucky, a few of your startup lottery tickets will pay off.

Gus Bessalel is a serial entrepreneur, angel investor, and the author of The Startup Lottery: Your Guide to Navigating Risk and Reward. A former Inc. 500 CEO and 30-year veteran of startup life, he has a BA and MBA from Harvard University. He writes about entrepreneurship and careers in venture-backed startups.

Thanks for the insightful post! Question for Gus - what are some early signs (e.g. LT, market, traction, culture) that could signal if a startup is set on long-term success vs failure and what are some tactics that potential employees could use to notice and interpret those signs?

This is a great article, I wish I would have known all this long back! I have 10 spent years in 5 startups and have gone through every failure scenario you mentioned. Stocks don't vest, you don't know when to leave, if you leave - the company becomes a blockbuster or simply goes bust.

However, the positive side of these experiences is that you learn a LOT. Learning curve is probably higher than a stable job. Also, you learning is multi-disciplinary :)